26 March – 26 June 2020

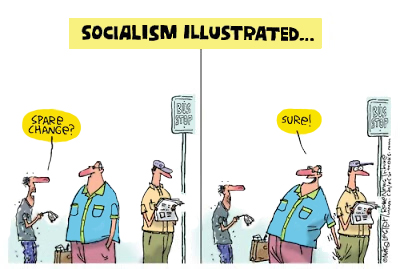

Some Americans have much higher income and wealth than others. Former President Barack Obama explained, “I do think at a certain point you’ve made enough money.” An adviser to Rep. Alexandria Ocasio-Cortez who has a Twitter account called Every Billionaire Is A Policy Failure tweeted, “My goal for this year is to get a moderator to ask ‘Is it morally appropriate for anyone to be a billionaire?’” Democratic presidential hopeful Sen. Elizabeth Warren, in calling for a wealth tax, complained, “The rich and powerful are taking so much for themselves and leaving so little for everyone else.”

… You say, “Williams, that’s lunacy.” You’re right. In a free society, people earn income by serving their fellow man. Here’s an example: I mow your lawn, and you pay me $40. Then I go to my grocer and demand two six-packs of beer and 3 pounds of steak. In effect, the grocer says, “Williams, you are asking your fellow man to serve you by giving you beer and steak. What did you do to serve your fellow man?” My response is, “I mowed his lawn.” The grocer says, “Prove it.” That’s when I produce the $40. We can think of the, say, two $20 bills as certificates of performance — proof that I served my fellow man.

A system that requires that one serve his fellow man to have a claim on what he produces is far more moral than a system without such a requirement. For example, Congress can tell me, “Williams, you don’t have to get out in that hot sun to mow a lawn to have a claim on what your fellow man produces. Just vote for me, and through the tax code, I will take some of what your fellow man produces and give it to you.”

Let’s look at a few multibillionaires to see whether they have served their fellow man well. Bill Gates, co-founder of Microsoft, with a net worth over $90 billion, is the second-richest person in the world. He didn’t acquire that wealth through violence. Millions of people around the world voluntarily plunked down money to buy Microsoft products. That explains the great wealth of people such as Gates. They discovered what their fellow man wanted and didn’t have, and they found out ways to effectively produce it. Their fellow man voluntarily gave them dollars. If Gates and others had followed President Obama’s advice that “at a certain point” they’d “made enough money” and shut down their companies when they had earned their first billion or two, mankind wouldn’t have most of the technological development we enjoy today.

The only people who benefit from class warfare are politicians and the elite; they get our money and control our lives … We just might ask ourselves: Where is a society headed that holds its most productive members up to ridicule and scorn and makes mascots out of its least productive and most parasitic members?

Walter Williams

Is Income Inequality Fair?

(13 March 2019)

A Tale of Three Years – 2018, 2019 and 2020

The All Ordinaries Index (AOI), the Australian market’s benchmark, opened the first trading day of 2018 at 6,230. During the year it fell as low as 5,478 and closed its last day at 5,625. That’s a decline of 9.7%. Similarly, in 2018 the Dow Jones Industrial Average, Standard & Poor’s 500 and National Association of Securities Dealers Automated Quotations (usually known as NASDAQ) indexes – the American yardsticks that influence the AOI – decreased more than 9%; in December of that year they fell more than any December since 1931; and their plunges on 24 December produced the market’s worst-ever Christmas Eve. These reverses chastened the crowd; as a result, speculators (who mostly but mistakenly regard themselves as investors) became anxious. “Wall Street Slump Paints Scary Picture,” proclaimed The Australian on 21 December 2018 (see also “ASX Ends Worst Year Since 2011 with Worst post-GFC December Quarter,” The Australian Financial Review, 31 December 2018).

What a difference a year makes! To read the entire Newsletter, click here (pdf).

![]()